Colin Maher, Salary Cap Strategist and Contributor to No Trade Clause

We had our first splash this NBA offseason as the Chicago Bulls traded Alex Caruso for Oklahoma City Thunder’s Josh Giddey in a rare player-for-player trade. The general consensus believed the trade was a no-brainer for the Thunder, while many were of the impression the Bulls could have received more for Caruso.

Folks can debate whether the Bulls should have tried to obtain draft picks over a player who has essentially fallen out of the starting rotation for the Thunder. However, my critique comes more from the timing of when the Bulls decided to shop Caruso. As we break down the trade mechanics of this trade, there may have been more teams interested/able to be in on a trade for Caruso had they been more willing to trade him through the 2023-2024 trade deadline.

Let’s dive in.

The Trade Mechanics

The Trade Math

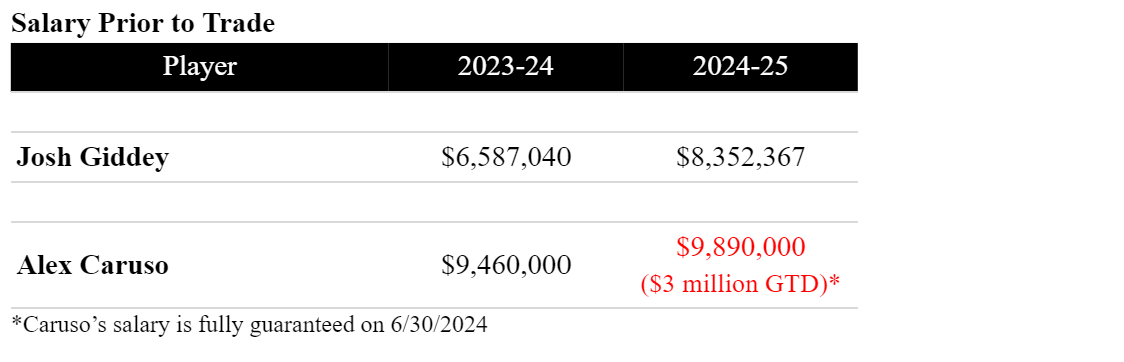

Because the trade occurred in June, we are still in the 2023-2024 salary cap year (new year to begin July 1st). As a result, determining what salary to use for the “trade math” gets a little tricky.

First, when calculating outgoing trade salary, you have to reduce the amount of non-guaranteed salary. This eliminates teams from “salary dumping” players when executing trades. However, in June, the Player’s salary for the 2023-2024 season is fully earned. So there’s a second step.

If a trade occurs after the regular season and before the new salary cap year (like this trade), you take the lesser of the (i) current season’s contract and (ii) the player’s guaranteed salary for the 2024-2025 season.

This is where things get interesting for Caruso, who has earned $9.4 million in 2023-2024, and only had $3 million guaranteed for 2024-2025 until it becomes fully guaranteed on June 30th.

Therefore, if nothing was amended, Caruso’s outgoing salary would only be $3 million to Giddey’s incoming salary of $6,587,040. Even using the Expanded Traded Player exception, which allows for the greatest amount of incoming salary in return (200% + $250k in this situation), the Bulls would not have been able to execute the trade as of June 21st when the trade was executed.

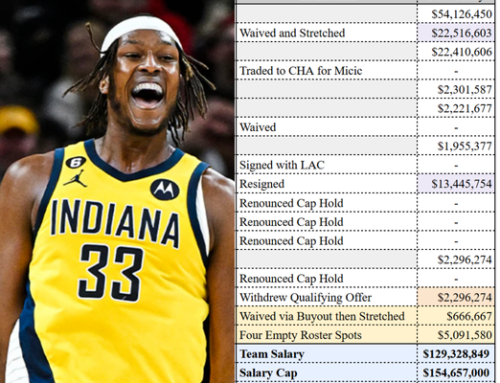

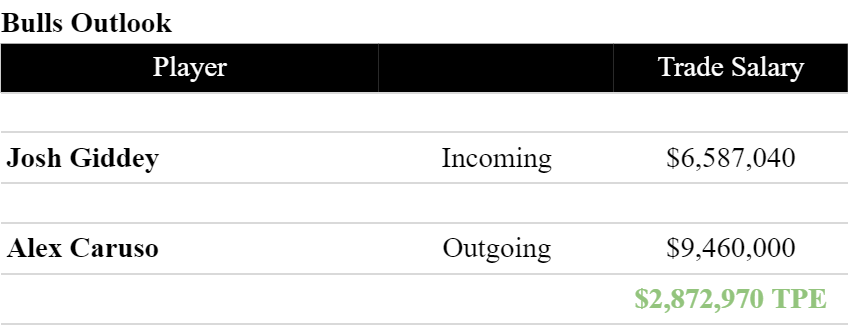

The Bulls Trade Mechanics

But what can the Bulls do? They went ahead and fully guaranteed the 2024-2025 salary now. This meant that the $9,460,000 2023-2024 salary (which was less than the $9,890,000 fully-guaranteed 2024-2025 salary) was the outgoing salary to be used. Because it was a larger than Giddey’s incoming salary, they use the “Standard TPE”, which allows them to create a $2.8 million trade exception that can be used at a later date.

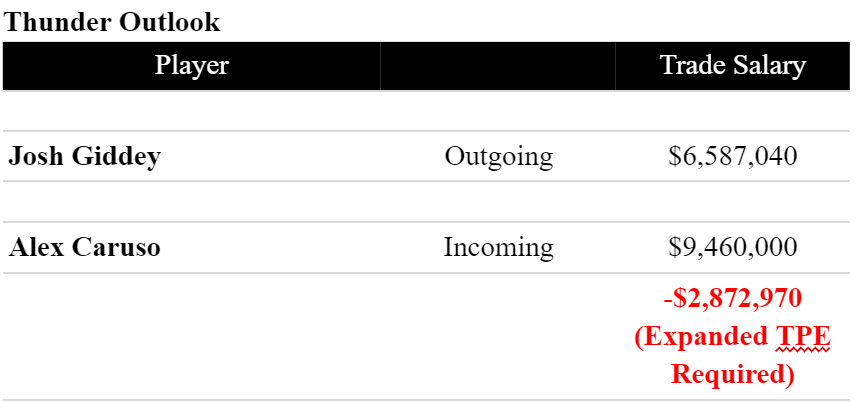

The Thunder Trade Mechanics

From the Thunder’s perspective, they have no qualms over the fully-guaranteed contract because they were about to do that anyway. Their incoming trade salary is the $9,460,000 while Giddey’s $6,587,040 is the outgoing salary. Because their outgoing salary is less, they are required to use the Expanded TPE discussed above to execute the trade, which is only permitted for teams under the First Apron.

One key change in the 2023 CBA: If a team uses an exception after the regular season that is restricted by one of the aprons, then they can’t go over that apron for the subsequent salary cap year. Therefore, the Thunder are “hard capped” from going over the First Apron for the entire 2024-2025 season (note they sit roughly $70 million under the First Apron if exercising all their team options and signing their first round pick with three roster spots open).

The Offseason Market vs. the Trade Deadline Market

In a previous article I explained some key changes implemented this offseason and into the 2024-2025 salary cap year as a result of the new CBA.

As stated above, my critique of the Bulls trade isn’t their return of Giddey, but their timing for shopping Caruso. Below are the newly implemented trade limitations that might have eliminated trade suitors for Caruso:

Second Apron Limitations

Teams over the Second Apron now have the most difficult time executing trades. Not only are they limited to acquiring incoming salary at a dollar-for-dollar rate, but they cannot aggregate contracts (e.g. combine small salaries to reach the amount of outgoing salary required). In other words, unless a Second Apron team had a player with a salary of $9,460,000 they are willing to part with (and one the Bulls are willing to acquire), then they are out of the running for Caruso.

At the deadline, Second Apron teams still had the Transition TPE available with the ability to aggregate contracts (similar to the Second Apron Clippers trading for Harden).

Subsequent Year Hard Cap

As stated above, if a team uses an exception (e.g. the Expanded TPE) after the regular season, they are now “hard capped” from exceeding the applicable apron (e.g. the First Apron for the Expanded TPE) through the follow year from. While the Thunder may not have an issue with this, being $70 million away from the threshold, those teams flirting with the First Apron might as they don’t want to have those First Apron limitations moving into the rest of the offseason. Had Caruso been traded at the deadline, those teams flirting with the First Apron wouldn’t have to worry about being hard capped for 2024-2025, but only through the rest of the 2023-2024 season when additional transactions are going to be limited.

First Apron Limitations

Teams over the First Apron now have to match their outgoing salary with incoming salary on a dollar-for-dollar basis. At the deadline, teams still had the “Transition TPE” allowing all teams to acquire players for 110% of incoming trade salary.

Conclusion

There’s no telling how willing the Bulls were to trade Caruso before this offseason, but there is no doubt they would have had a larger trade market at any point prior to when he was dealt simply as a result of newly-implemented restrictions. Now we’ll see if they’ll have similar issues unloading larger contracts as they’re set to rebuild.