Now that we’re past the deadline for Rookie Scale Extensions in 2024, I wanted to take a look those contracts that were signed this offseason in comparison to those signed since 2021. In this article I review the key terms for all Rookie Scale Extensions since 2021 and provide takeaways from each offseason. How has the new CBA shaped Rookie Extensions in 2023 and 2024 compared to years prior, and what trends might we see continue moving forward?

Let’s dive in.

Rookie Scale Extensions

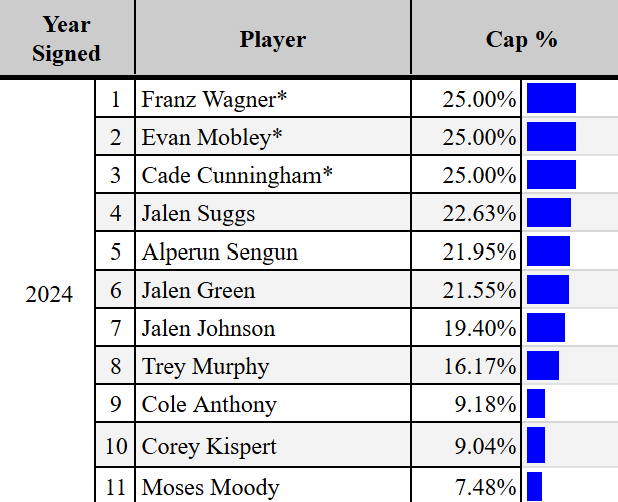

First thing’s first, I want to provide the contract details for all Rookie Scale Extensions since 2021. The figure below provides a summary.

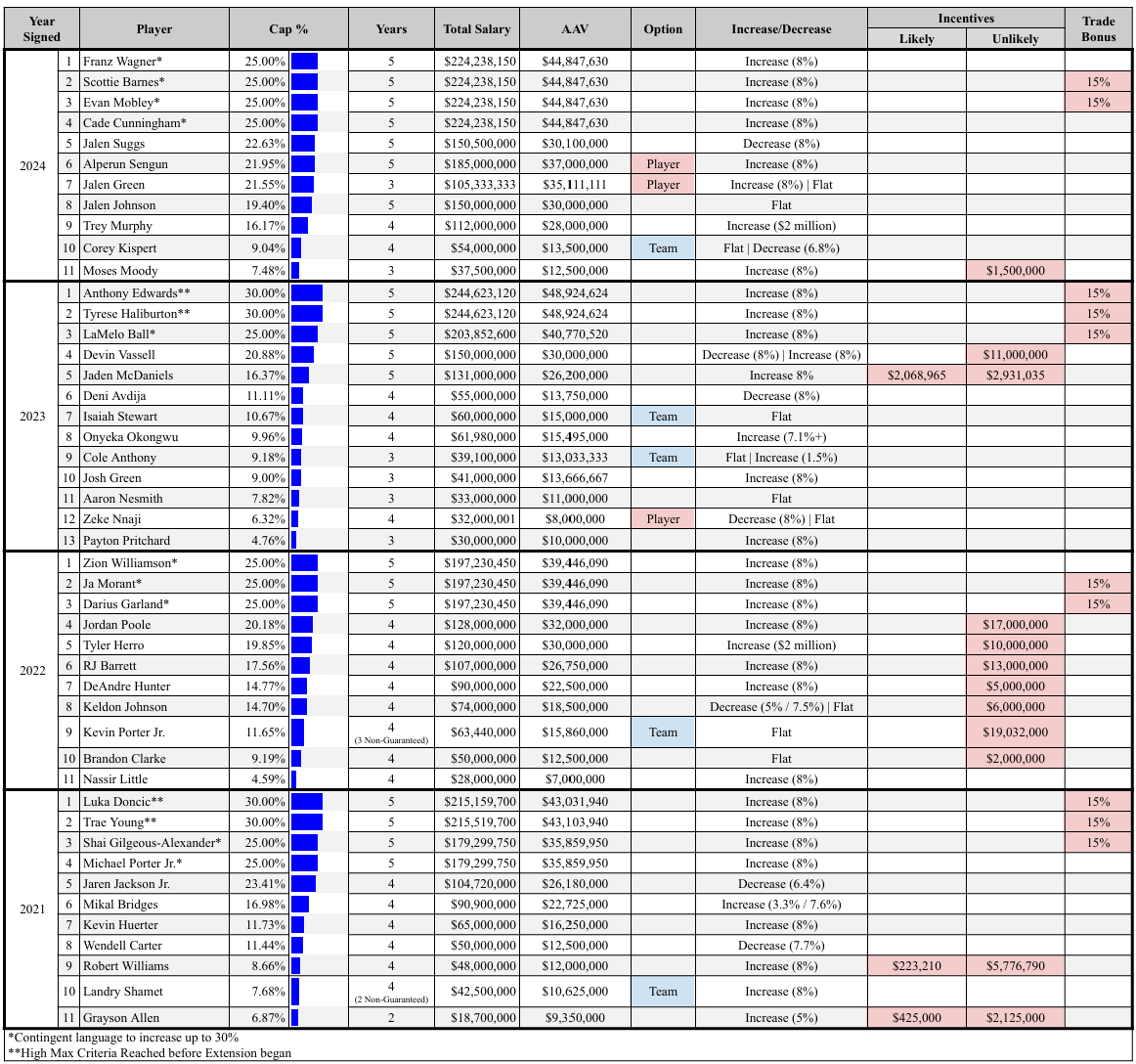

Thirteen Rookie Scale Extensions were signed in 2023, while 2024, 2022 and 2021 each had eleven. This means that each draft class has close to one-third of their First Rounders sign Rookie Scale Extensions. After reviewing the terms in the chart below, you can read on to find my key takeaways from this information.

Key Takeaways

My key takeaways are broken down into five subjects:

- Incentives;

- Trade Bonuses;

- Salary Cap Percentage;

- Length of Extension;

- Options

Incentives

Under the new CBA, both likely and unlikely bonuses count toward a team’s Apron Salary (i.e. they contribute toward potential roster building limitations). With that change, incentives have become less…likely…in contracts.

In 2022, 64% of Rookie Scale Extensions had incentives (all unlikely). That dropped to just 15% in 2023 with the rule change. This year, only one player received incentives (Moses Moody – $1.5 million total unlikely).

Trade Bonuses

Veteran Extensions and Free Agent signings tend to have a higher likelihood of containing a trade bonuses irrespective of the amount of salary the player is receiving. As for Rookie Scale Extensions since 2021, Trade Bonuses have only been included in Designated Rookie Scale Extensions (the maximum extension for a player on a Rookie Scale Contract). Across all Designated Rookie Scale Extensions, 69% of players have a Trade Bonus, all of which are for the maximum allowable 15%.

Salary Cap Percentage in First Season

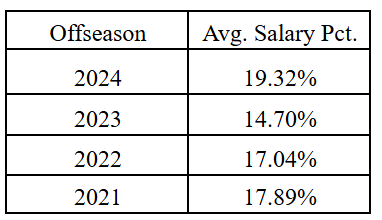

Interestingly enough, 2023 had the biggest dip in the amount paid by percentage of the salary cap, despite having two players who hit the “Higher Max Criteria” allowing them to jump from 25% to 30% of the Salary Cap. It’s hard to state the reason for the dip in salary in 2023. However, 2023 could simply have less overall talent in the First Round. Also, with the additional roster-building limitations in effect under the new CBA, both the player and team are more motivated to reach an agreement and avoid free agency altogether. Players receiving less than 10% of the Salary Cap may have been more inclined to test free agency in seasons past, and teams had more avenues to replace that player prior to the additional Apron limitations.

Length of Extension (including Options)

Average Length

Under the new CBA, a 5-year Rookie Scale Extension is no longer required to include the maximum salary of 25%. This caused a slight uptick in average length this offseason.

5-Year Extensions

Two 5-year, non-max Rookie Scale Extensions were offered in 2023 when teams could first do so. This offseason, three were offered.

Average percentage cap for those contracts was 20.25%.

4-Year Extensions

The number of 4-year Extensions dropped from eight in 2022 to four in 2023 to just two this offseason because teams are permitted to offer 5-year Extensions for non-max players.

Average cap percentage for 4-year Rookie Scale Extensions is 12.78%.

3-Year Extensions

In 2021 and 2022 only 4-year and 5-year Rookie Scale Extensions were agreed upon other than one outlier 2-year Rookie Scale Extension (Grayson Allen, the only 2-year Extension in all four offseasons). There were four 3-year Rookie Scale Extensions in 2023 and two in 2024, which makes up more than 25% of all Rookie Scale Extensions in those years.

Average cap percentage for three-year Rookie Scale Extensions: 9.97%.

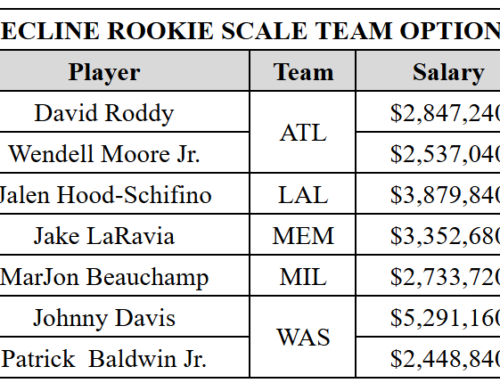

Options

This year, 30% of Rookie Scale Extensions had an Option (2 Player; 1 Team). The 2023 offseason had two Team options and one Player option, but more Extensions in general, dropping the number of players with options to 23%. There was only one Team Option offered in each season in 2021 and 2022. We’ll see if the trend continues to increase moving forward, as players and teams will try and get more creative to make a Rookie Scale Extension happen to avoid free agency.

Conclusion

Front offices are forced to get creative in the dealmaking process to retain talent and avoid trying to replace players when avenues for roster-building are limited as team salary increases over the Aprons. With this in mind, along with the lack of options a player might have in free agency for the same reasons, I could see the terms of Rookie Scale Extensions becoming more unique. We will find more Rookie Scale Extensions that are for less money (Korey Kispert), less seasons (Jalen Green) or might contain an Option to allow a deal to be reached.