Teams with players drafted in the First Round in 2022 and 2023 were required to exercise their 2025-2026 Team Option by October 31, 2024. The players whose Team Options were declined will become unrestricted free agents this offseason.

Below I analyze the players on the final year of their Rookie Scale Contract whose Team Option was declined for the 2025-2026 season. I review the specific team scenarios that may have influenced the team’s decision, and provide the team’s likelihood to trade the player based on their current financial status.

Let’s dive in.

Summary

2022 Draft

Of the 30 players on Rookie Scale Contracts from the 2022 draft (note that all First Round picks sign Rookie Scale Contracts):

- 23 – Players had their 4th Year Team Option exercised for 2025-2026;

- 6 – Players’ 4th Year Team Options were declined this offseason;

- Note – AJ Griffin’s Team Option was declined as part of a buyout as he sought to step away from basketball activities;

- 1 – Player was waived prior to exercising any Rookie Scale Team Option (TyTy Washington).

2023 Draft

Of the 30 players on Rookie Scale Contracts from the 2023 draft:

- 29 – Players had their 3rd Year Team Option exercised for 2025-2026;

- 1 – Player’s 3rd Year Team Option was declined this offseason (Jalen Hood-Schifino)

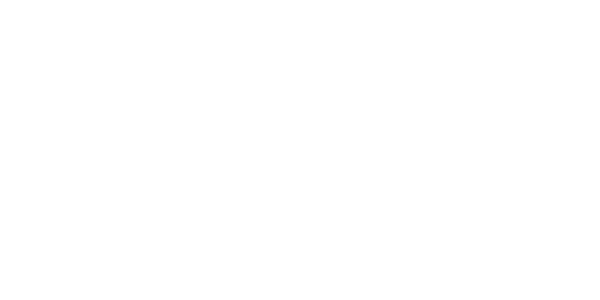

Below are those players along with their career statistics (colors are scaled across all active NBA Players in 2023-2024):

Team Scenarios

It’s understood that if a player was impressing his Team’s front office, his Team Option would be exercised regardless of the team’s current scenario. However, there may be other reasons outside of the player’s performance that may contribute to the Team’s decision to decline the player’s Team Option.

Across the six teams I found three circumstances that may contribute to a team’s decision: (1) Player was not drafted by his current team or management, (2) Team has a current financial scenario that would favor dumping expiring contracts this season and (3) Team has a financial scenario in the 2025 offseason that would place great value on lowering its salary obligations.

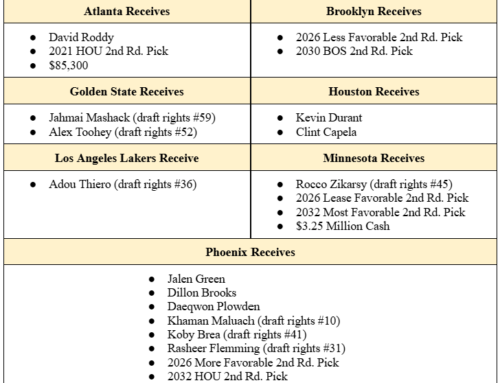

Not Drafted by Team/Management (ATL, DET, WAS)

Washington’s prior management drafted Davis and Baldwin, Jr. before Michael Winger became the President last offseason. Atlanta and Detroit didn’t use a First Round Pick to acquire their players. Roddy was acquired s a role player in exchange for E.J. Liddell, who they had acquired earlier in the offseason from the Dejounte Murray trade. For Detroit, Moore Jr. was acquired in a four-team trade along with Bobi Klintman’s draft rights in exchange for Cam Spencer’s draft rights. Both Moore Jr. and Roddy were traded from their prior teams due to cost-cutting measures.

When the current decisionmaker didn’t draft the player, it’s doubtful they feel the same way as the team/management that scouted and drafted the player. They have less invested emotionally into the player. They also won’t feel the sunk cost of using the First Round Pick on the player just two years ago, because they weren’t the ones who acquired the player with a First Round Pick. Both from a mental standpoint and optically, it’s easier to decline the player’s Team Option in this scenario.

Financial Consideration: Current Season (ATL, LAL, MIL)

One might ask, “Why does declining 2025-2026 salary matter if the team is focused on cutting this season’s salary?” An expiring contract is easier to trade to another team than a contract with salary tacked on in 2025-2026. More teams are willing to take on the salary obligation this year with the understanding their flexibility remains the same in the 2025 offseason.

Atlanta – The Hawks are sitting $1.2 million below the Tax Threshold with $3.25 million in unlikely incentives that, if triggered, could push the Hawks into the tax. Dropping Roddy’s salary could provide tax relief if over $1 million of those unlikely incentives look like they might be triggered, or he could be used as outgoing salary in a larger trade.

Los Angeles/Milwaukee – Both the Bucks and Lakers are well into the tax this season and are subject to the “repeater” tax this year. Both teams have their 15 roster spots filled, which means they could trade Hood-Schifino/Beauchamp and not be required to fill the open roster spot. Dropping their salary would save the Lakers $14.98 million and the Bucks $15.46 off their luxury tax bill at the end of the season. Look for both teams to hold onto these players up to the trade deadline in case they’re needed as outgoing salary to facilitate a larger trade. Otherwise, they could be sent to another team as a cost-cutting measure.

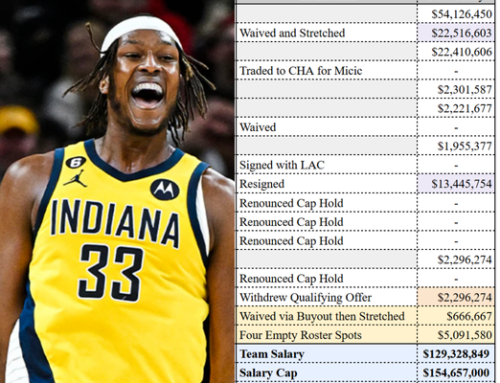

Financial Consideration: 2025 Offseason (DET, MEM, WAS)

Detroit/Washington – After the Kispert extension, the Wizards have $25.8 million in salary cap space in 2025, and could have up to $40 million should they waive non-guaranteed salaries. Exercising the options of Davis and Baldwin, Jr. would have cut that initial amount down to $14.7 million. The Pistons will have $27 million in cap space if they decide to waive Paul Reed’s non-guaranteed salary. With just a handful (or potentially less) of teams with salary cap entering the 2025 offseason, it behooves the Wizards and Pistons to increase their cap space as much as possible to gain leverage in the free agent market, or have the ability to absorb unwanted contracts in exchange for other assets, should that be the route this offseason. It should be noted that the Wizards are also over the salary cap for the current season, and having the expiring contracts of Davis and Baldwin, Jr. could also help facilitate a trade during the season this year.

Memphis – Memphis made several cost-cutting maneuvers to stay below the Luxury Tax threshold for this season. None of those included trading LaRavia. However, it looks like Memphis wants financial flexibility entering the 2025 offseason, as they also did not extend Santi Aldama by the October 21st deadline, making him a restricted free agent this offseason. In 2025-2026, Memphis sits slightly over the salary cap with Jaren Jackson Jr.’s extension looming, which will kick in starting in 2026-2027.

Likelihood of Trade

Using Exceptions

Due to the players’ low salaries, there are ways that essentially every team across the league can acquire these players without the need to send outgoing salary, and some may not need to waive a current player to open a roster spot. Let’s break those numbers.

- Extra Roster Spots – As of today, eleven teams have an open roster spot, meaning they are not required to cut one of their players to acquire an additional player.

- Bi-Annual Exception (BAE) – Twelve teams have the Bi-Annual Exception available, which can be used to acquire a player via trade. All players but Davis would fit into the BAE.

- Mid-Level Exception (MLE) – Twenty-four teams have all or a portion of their MLE, the majority of which are large enough to absorb the salary of any player discussed in this article.

- Traded Player Exception (TPE) – Eleven teams have a large enough TPE to absorb the salary of any player on this list, and nine teams have a TPE large enough to absorb at least one of the salaries on this list (note other teams have TPE’s, but are unable to use them due to Apron limitations).

Players’ Likelihood of Trade (organized by Salary)

David Roddy (ATL) – $2,287,240

Roddy has been playing a rotational role with Atlanta so far this season, playing over 18 minutes per game. I can see Atlanta sticking with Roddy for the remainder of the season unless his salary was needed in a larger trade, or they had to relieve his salary to stay under the tax.

Wendell Moore, Jr. (DET) – $2,527,040

Moore, Jr. was acquired by Detroit in a cost-cutting measure by Minnesota. He was never able to crack the rotation in Minnesota, and hasn’t had much luck as of yet with Detroit until recently due to injuries. However, without any financial pressure to clear salary, it’s unlikely there’s a trade scenario for Moore, Jr. unless more cap space is needed by Detroit in a separate trade.

MarJon Beauchamp (MIL) – $2,733,720

Beauchamp is a likely candidate to be traded for two reasons. First, Beauchamp has been playing for a title contender since he was drafted. Oftentimes, it’s difficult to crack the rotation as those teams will heir on the side of veteran experience over player development. A player like Aaron Nesmith comes to mind for the Boston Celtics – a player who could never show he was a legitimate player in the league because he couldn’t gain significant minutes until he was traded to Indiana.

Second, Milwaukee is expensive. As stated above, they can unload Beauchamp’s salary without having to replace him and they’ll save over $15 million off their tax bill. If a team scouted Beauchamp and liked what they saw, it may be an opportune time to acquire Beauchamp and bring him into their organization if he’s not involved in a larger trade.

Jake LaRavia (MEM) – $3,352,680

LaRavia may be the most seasoned player on the list, and one of the more surprising to not have his Team Option exercised. LaRavia played over 23 MPG last year and has increased to 25 MPG this season for Memphis-though some of his playing time may have to do with how injury plagued Memphis has been. I doubt, especially with their injury concerns, Memphis would look to unload LaRavia this season unless as part of a larger trade for considerable talent.

Jalen Hood-Schifino (LAL) – $3,879.840

The Lakers are not poised to have patience in the development of their players as they try to win now with LeBron. Hood-Schifino has been plagued by injuries, only playing in 21 games last season before becoming the only player in the 2023 draft to have his Team Option declined. This season, Hood-Schifino is primarily playing for the Lakers’ G League team. Look for Hood-Shifino to be moved in a salary cutting measure should the Lakers need to clear salary to acquire another player. If he’s still on the team at the deadline, a team may be able to acquire him for little or no assets as a cost-cutting measure for the Lakers. The Lakers may not be as expensive as the Bucks, but they can still save close to $15 million by unloading a player that appears to not have a future with the team.

Johnny Davis & Patrick Baldwin Jr. (WAS) – ($5,291,160; $2,448,840)

Washington isn’t in a financial crunch that will force their hand into trading either player, and Davis has a large enough salary that teams would have to think twice before absorbing his salary. The Wizards will most likely hold both players and use them as outgoing salary if needed in a larger trade. Otherwise, I wouldn’t be surprised to see the players walk at the end of the season.

Conclusion

These teams have already made the decision that a former First Round Pick isn’t worth investing another season in, despite the relatively low salary. While the players sit on their current team in a lame duck year, it may be prudent of any team who liked the film on any of these players to acquire the player this season to get him assimilated into the organization for a better evaluation of the player while also obtaining his bird rights. It seems that it would take minimal assets to do so, though the trade may have to come at the tail end of the trade deadline as teams wait to see if the player is needed in a larger trade.