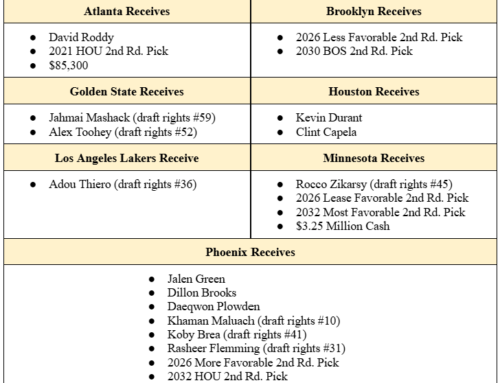

The Phoenix Suns recently waived and stretched the salary of E.J. Liddell and Nassir Little. Liddell was waived shortly after being acquired via trade for David Roddy in a deal that at the time was anticipated as a tax-savings maneuver.

Most everyone knows the Suns’ inflated Team Salary is going to subject them to a historic tax bill at the end of the year unless they decide to significantly change their roster. Because of the high tax bracket for the Suns, any minor savings in their Team Salary can save them multiples in their tax liability.

So how much did the trade for Liddell and subsequent waivers of Liddell and Little save them in tax liability this season, and what does it mean for years to come?

Let’s dive in.

Suns are a Non-Repeater Tax Team

The first step in determining the Suns potential tax bill is determining if they are a “Repeater” tax team as defined under the CBA. A team is a Repeater if, at the time of assessing tax liability, the team was a tax team in three of the four prior seasons (i.e. not counting the current season).

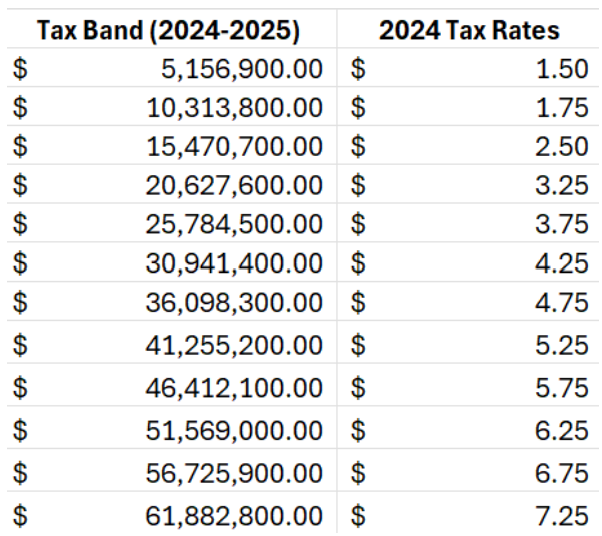

The 2020-2021 through 2023-2024 seasons will be used to determine repeater status at the end of this season when tax liability is determined. According to spotrac.com, the Suns were only a tax team in two of the four previous seasons. Therefore, they will be subject to “Non-Repeater” tax rates below.

Tax Liability After the Trade and Waivers

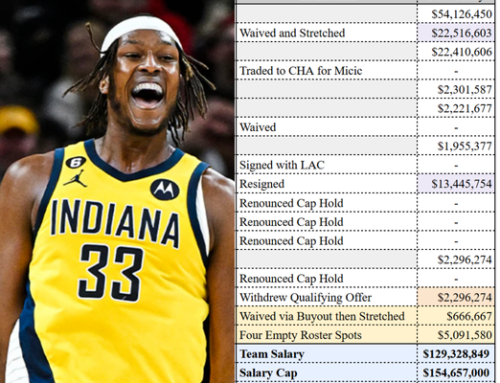

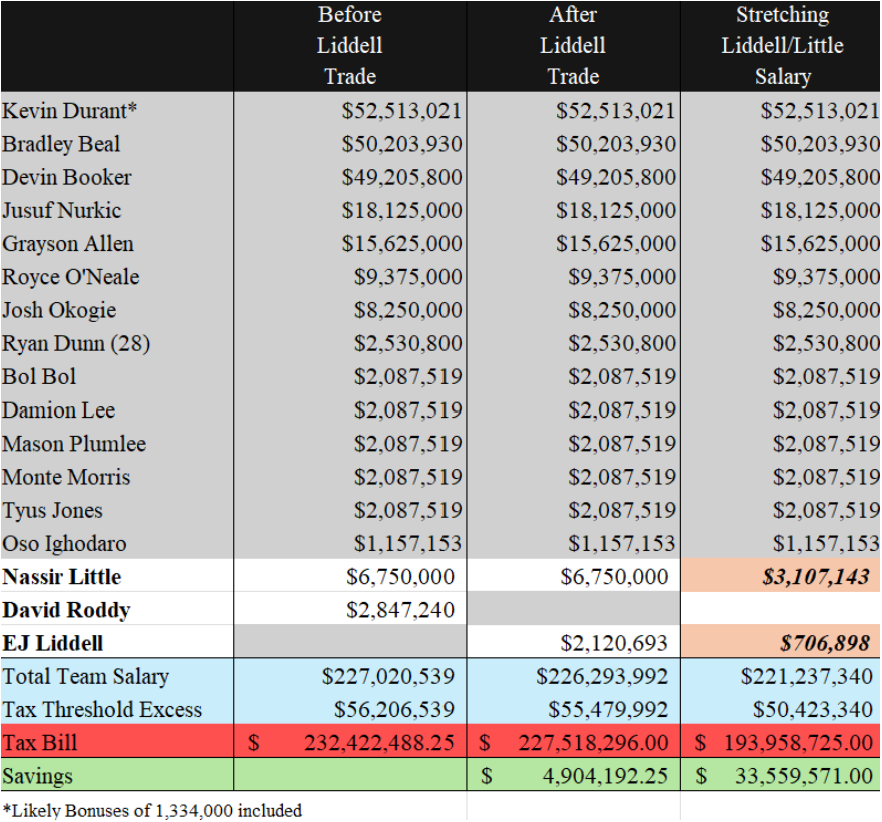

First, trading Roddy for Liddell lessened their Team Salary by $726,547. This minor change saved them almost $5 million even before making any additional moves.

Second, the Suns waived Liddell and Little. Liddell had $2,120,693 guaranteed salary remaining in his final season. Little had $21,750,000 in guaranteed salary remaining over three seasons.

The salary becomes “dead salary” that will remain as part of the Suns’ Team Salary, but the Suns elected to “stretch” the dead salary over a longer period of time.

Stretching dead salary spreads the total amount owed evenly over twice the remaining years left on the waived contract, plus one additional year. Liddell only had the 2024-2025 season remaining, thus his dead salary was spread over three seasons at $706,898, while Little had three seasons remaining, allowing the dead salary to be spread over seven seasons at $3,107,43.

The chart below shows the significant savings of over $33 million dollars resulting from stretching the two players. This is a snapshot of the Suns’ Team Salary as it stands currently for this season. Team Salary can adjust as the year goes on until a “snapshot” is made on the final day of the Regular Season, which is then subject to some adjustments.

Suns Facing a Massive Tax Bill in 2025-2026

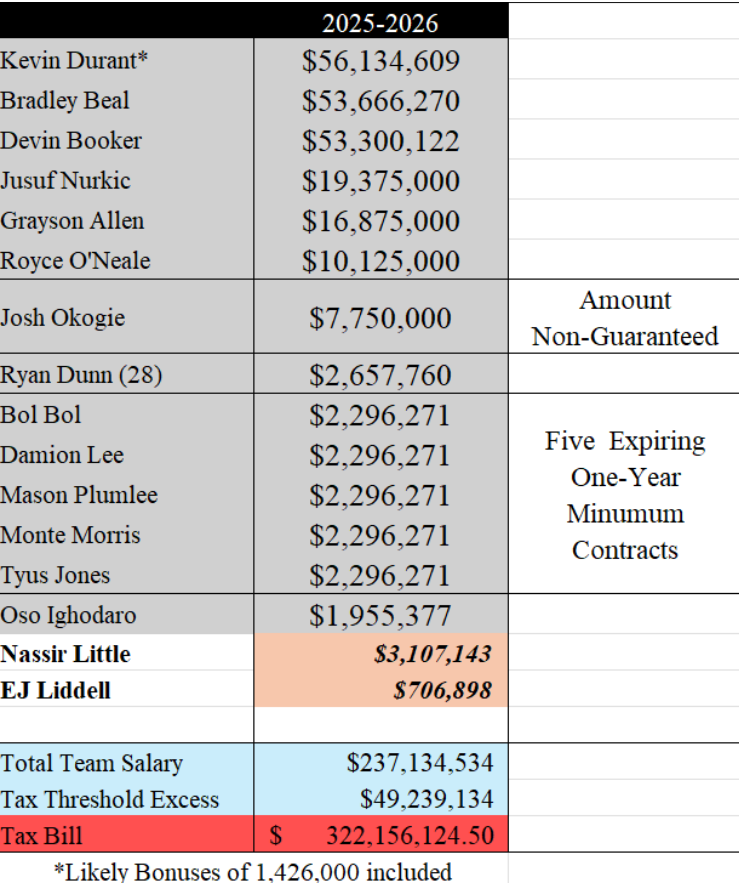

If the Suns decide to keep their three stars, it’s hard to see a scenario where they duck below the tax threshold, as they would only have $26 million in room below the threshold after paying Durant, Booker and Beal to fill the rest of their roster.

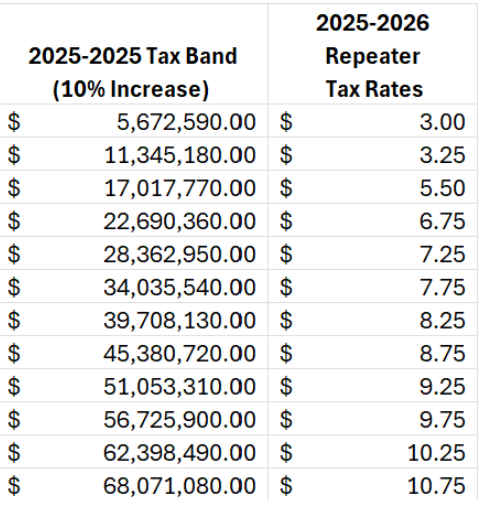

With this in mind, the Suns would be a “Repeater” in 2025-2026, when the CBA implements its tax rate hikes (see below).

Assuming the presumed ten percent raises in the Salary Cap-which in turn raises the tax threshold, tax brackets and minimum player salaries-the Suns would have a $322 million tax bill should they bring back a similar team next season (see below). This does not include actually paying their Team Salary.

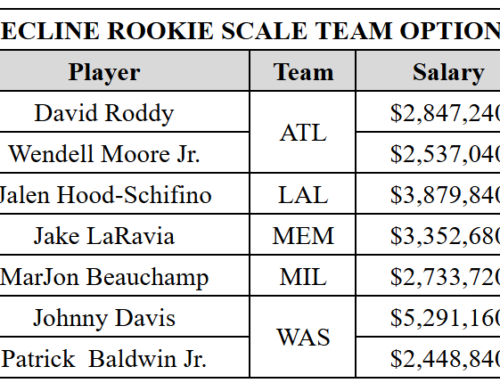

It should be noted that if they do decide to bring back their three stars, there is not much wiggle room as far as salary is concerned, but even minor adjustments significantly affect the tax bill due to the massive tax rates. As an example, one option is waiving Joshua Okogie’s non-guaranteed salary and picking up yet another minimum salaried player (they already have five this season), which would save them roughly $5.5 million in Team Salary. This would save them an astonishing $49.6 million in tax liability. However, to shed any additional Team Salary would mean being willing to part with Jusuf Nurkic, Royce O’Neale or Grayson Allen for lesser salaried players.

Conclusion

The Suns showed examples of how minor transactions can save a team millions when operating in higher tax brackets. There is now a short window to determine if it is worth moving forward with such a high tax bill or if it will be time to make significant changes during the 2025 offseason to avoid the Repeater Tax and look for new ways to become a contender.